Consequences of Late Filing of GSTR-1 and GSTR-3B, Get Practical GST Course in Delhi, 110086, by SLA Consultants India, New Delhi

Mar 24th, 2025 at 05:04 Learning Delhi 77 views Reference: 97Location: Delhi

Price: Free Negotiable

Consequences of Late Filing of GSTR-1 and GSTR-3B and Practical GST Course by SLA Consultants India, Delhi

The Goods and Services Tax (GST) system in India has revolutionized the tax landscape, simplifying the indirect tax structure. However, one critical aspect of GST compliance is the timely filing of returns, particularly GSTR-1 and GSTR-3B. Failing to adhere to the prescribed deadlines can lead to various consequences, including financial penalties and legal complications.

Consequences of Late Filing of GSTR-1 and GSTR-3B

-

Late Fees and Penalties:

The most immediate consequence of late filing is the imposition of a late fee. For GSTR-1, a late fee of 50 per day (25 for CGST and 25 for SGST) is charged, while for GSTR-3B, the late fee is 50 per day as well. This fee continues to accumulate until the return is filed, which can lead to a significant financial burden over time. -

Interest on Late Payment of Tax:

If GST payments are delayed due to late filing of GSTR-3B, interest is charged on the unpaid tax amount. The interest rate is 18% per annum, calculated from the due date of payment until the date of actual payment. This adds to the cost of non-compliance and can significantly impact a business’s cash flow. -

Blockage of Input Tax Credit (ITC):

A critical consequence of late filing is the potential blockage of Input Tax Credit (ITC). If GSTR-1 is not filed on time, recipients of goods and services may not be able to claim ITC on purchases. This can disrupt the entire supply chain and force businesses to pay taxes out of pocket, rather than offsetting them with the available ITC. -

Risk of Scrutiny and Penalties:

Consistent non-filing or late filing of GST returns increases the risk of scrutiny by the GST authorities. Taxpayers who habitually fail to file on time may be subject to audits and investigations, leading to penalties, interest, or even legal action. Additionally, if there is a discrepancy or mismatch in data across GSTR-1 and GSTR-3B, the authorities may question the taxpayer, leading to further complications. -

Impact on Business Reputation:

Regular delays in filing returns can tarnish a company’s reputation, affecting relationships with suppliers, customers, and business partners. Vendors may hesitate to engage with a company that does not maintain proper GST compliance, potentially leading to disruptions in business operations. -

Ineligibility for GST Refunds:

Consequences of Late Filing of GSTR-1 and GSTR-3B, Get Practical GST Course in Delhi, 110086, by SLA Consultants India, New Delhi

Businesses that file returns late may face delays in claiming GST refunds. The GST law mandates timely filing of returns as a prerequisite for refund claims, and delayed filings could make a business ineligible to receive the refunds they are owed.

Practical GST Course by SLA Consultants India

For individuals and businesses looking to better understand GST compliance and avoid the repercussions of late filing, SLA Consultants India, based in New Delhi, offers a Practical GST Course in Delhi. This comprehensive course covers all the critical aspects of GST, focusing on the practical application of the laws and procedures related to GST return filing, tax calculation, invoicing, and record-keeping.

The course includes in-depth training on how to file GSTR-1 and GSTR-3B correctly, the consequences of errors, and best practices for timely compliance. It is designed for professionals in accounting, taxation, finance, and those interested in starting a career in GST. With expert trainers, hands-on practice, and real-world case studies, SLA Consultants India ensures that participants gain practical knowledge that can be directly applied in their work.

The course, offered at their Delhi center (PIN Code: 110086), is an excellent opportunity for professionals to stay up-to-date with the latest GST provisions, avoid common filing mistakes, and ensure timely compliance with the law.

In conclusion, understanding the consequences of late filing and obtaining practical knowledge through professional courses like those offered by SLA Consultants India is essential for every business and tax professional. This will not only help avoid financial penalties and legal issues but also enhance business operations through effective GST management.

SLA Consultants Consequences of Late Filing of GSTR-1 and GSTR-3B, Get Practical GST Course in Delhi, 110086, by SLA Consultants India, New Delhi Details with "New Year Offer 2025" are available at the link below:

https://www.slaconsultantsindia.com/certification-course-gst-training-institute.aspx

https://slaconsultantsdelhi.in/gst-course-training-institute/

GST Training Courses

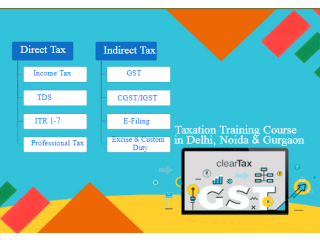

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/

![Data Analyst Training Course in Delhi, 110009. Best Online Live Data Analyst Training in Patna by IIT/MNC Faculty , [ 100% Job in MNC] Sept Offer'24](https://www.postkare.com/storage/files/in/20/thumb-320x240-e574fff64cae8a9bad98a0b371b1389b.png)

![Top 12 Business Analyst Courses in Delhi, 110072 - With Placements "New Year Offer 2025" by [ SLA Consultants India]](https://www.postkare.com/storage/files/in/57/thumb-320x240-679bda17b8615b16c69d4aadb9b6a0a2.png)

![Job Oriented Data Analyst Course in Delhi.110011 . Best Online Live Data Analytics Course in Delhi NCR by IIT. [ 100% Job in MNC]](https://www.postkare.com/storage/files/in/33/thumb-320x240-e5fe8ab2255606977b305a9098ac2267.png)